We have the largest collection of award-winning quality training content in banking and insurance designed by experts to demonstrate our commitment to enabling clients achieve outstanding results. Our modular approach to training and development is flexible and allows for specific programmes to be created using any combination of the numerous modules. Programmes are delivered in both classroom format and digitally enabled blended learning pathways.

Our training solutions have been developed after a rigorous study of the needs of Bancassurance staff in a modern and dynamic working environment. This is a culmination of over 30 years of study and research to develop not only the world’s best Bancassurance businesses but also the training and coaching that is needed to support them. As a result, we offer a full range of training solutions that covers needs of various levels of banking and insurance. We want to establish leadership in the financial services training industry by bringing together B2B businesses and B2C professionals on a single digitally engaging platform.

Sales and Leadership programmesWe offer the following selection of classroom based and digitally enhanced Blended Learning Pathways.

|

IPI GLOBAL SOLUTIONS - LEARNING PATHWAYS

| A unique approach to development |

|

1 | ||

| 2 |

|

Access to leading Global practitioners | ||

| Blended digital, classroom and live activities |

|

3 | ||

| 4 |

|

Ensure personal and business growth | ||

| Social learning, spacing, skill drills and solution focused coaching |

|

5 | ||

| 6 |

|

Award winning programmes | ||

| Embed learning and makes skills habitual |

|

7 | ||

| 8 |

|

Qualifies for UK CPD hours | ||

| Uses AI so the learning experience can be continually improved in real time |

|

9 | ||

| 10 |

|

Available anywhere, anytime on mobile devices, laptops and PCs | ||

| Supported by developmental on-line coaching from subject matter experts |

|

11 |

|

Lead Generation SkillsObjective of the course Who is it for? Total course duration: 7 Hours No. of modules: 19 |

| Sr. No. |

Module title | Type | Description/ Learning objective |

| 1 | Lead Generation Techniques | Video | Introduction to Lead Generation module |

| 2 | Personal introductions & understanding our customers | Classroom / Virtual | An introductory session to get to know each of your colleagues in a virtual meet. Get yourselves acquainted with a fundamentally different approach to the way you engage with customers. |

| 3 | Lead Generation Exercise - Virtual Meeting | Classroom / Virtual | Join the facilitator in a practical exercise session on Lead Generation |

| 4 | The Sales Drain | E-learning | There are so many opportunities to sell to customers where we can satisfy a genuine need, but all too often we allow customers to call into our branch and then leave without finding out anything about them at all. This course will change your perspective on how to leverage opportunities with customers. |

| 5 | Introduction to Conversational Selling | Digital Course | This introduces a whole new way to engage with customers with true “customer centricity” in mind. This e-learning module will help you understand the overall style and how to use this to optimise lead generation opportunities. |

| 6 | Lead Generation using Conversational Selling Skills - Virtual Meeting | Classroom / Virtual | Participate in the virtual/classroom meet to understand how this new approach differs from the current approach. Explore the impact of having a sales process that is the wrong way round and learn how to sell a product without even mentioning the product or insurance at all!! In other words, learn the secret of how to turn a sales activity into a buying event. |

| 7 | Handling Objection | Digital Course | This course elaborates on how to coax out all the common lead generation objections (do keep this restricted to lead generation at this stage). Recognise that some objections will never be overcome – especially if they are not being told the truth known as false objections. |

| 8 | Lead Generation - The Handover | Digital Course | Learn through this video how to handover a customer or prospect to a financial advisor. You will see a simple yet effective and professional handover from a lead generator to a financial advisor. |

| 9 | What good looks like so far | Video | Watch this real-time scenario video to understand how the scripts discussed earlier work to register the keywords to potential clients for a successful lead generation. |

| 10 | Timing & It’s all yours now – Handover - The Introduction Action | Video | Process of professional and seamless handover to complete the lead generation. |

| 11 | The Handover - Virtual Meeting | Classroom / Virtual | Having gained the customer’s agreement to speak to the Financial Advisor, we now need to make a seamless and professional hand-over to complete the lead generation process. Learn the skills to refer your customers effectively and professionally to the Financial Advisor and see how the Financial Advisor seamlessly takes control of the conversation. |

| 12 | Lead Generation Skills Practice - Virtual Meeting | Classroom / Virtual | This is your opportunity to see and be involved in practicing your skills with the Facilitator. See for yourself just how easy this is when we put the customer at the centre of our thinking and use conversational skills rather than a product push approach. |

| 13 | Choosing your moment | Digital course | This course elaborates on how to Understand when to avoid chatting to a customer and learn alternative ways of handling an opportunity when the branch or customer is busy. |

| 14 | E-learning Course - Articulate Assessment Test - 1 | Digital Assessment | Test your recently acquired knowledge skills with this simple assessment. Remember to give it your best shot to proceed towards the final accreditation process. |

| 15 | E-learning Course - Articulate Assessment Test – 2 | Digital Assessment | Test your recently acquired knowledge skills with this simple assessment. Remember to give it your best shot to proceed towards the final accreditation process. |

| 16 | Lead generation summary | Digital course | Watch and summarize the real-time scenario video again to understand how the scripts discussed earlier work to register the keywords to potential clients for a successful lead generation as also handle unexpected objections in the process. |

| 17 | Lead Generation Learning Review 1 | Digital course | Check your understanding of the Workshop through a learning review |

| 18 | Preparing for Role Play for Accreditation Centre | Video | Simple tips and guidance for getting through the process of Role Play for the Accreditation Centre without any stress. Enact a simple conversation with the assessor on board to make sure that your learning journey has incorporated the competencies thoroughly in a virtual meet. This will also act as an end assessment for the learner to gain his certification. |

| 19 | Accreditation Centre - Virtual Meeting | Classroom / Virtual | Enact a simple conversation with the assessor on board to make sure that your learning journey has incorporated the competencies thoroughly in a virtual meet. This will also act as an end assessment for the learner to gain his certification. Good luck! |

|

Conversational Selling SkillsObjective of the course Who is it for? Total course duration: 7 Hours No. of modules: 7 |

| Sr. No. | Module title | Type | Description/ Learning objective |

| 1 | Introducing Conversational Selling | Animated video | The video will also provide the learner with a brief introduction to this course. |

| 2 | Key and Chat Questions | Digital module | To equip the learner with the skills to uncover genuine customer needs and more information |

| 3 | Linking between the 4 Focus Areas | Digital module | Ways of closing a sale with customers and keeping the relationship going forward |

| 4 | Focus Upon Health, Medical and Protection | Digital module | Focusing on health, medical and protection |

| 5 | Closing Without Mentioning A Product | Digital module | Closing a sale without mentioning. product |

| 6 | Financial Needs Analysis | Digital module | Building on the four key questions using the financial needs analysis and illustrates how to ask for a referral |

| 7 | Closing Skills | Digital module | ;Participants will learn three ways to close the sale with customers and how to maintain the customer relationship going forward |

|

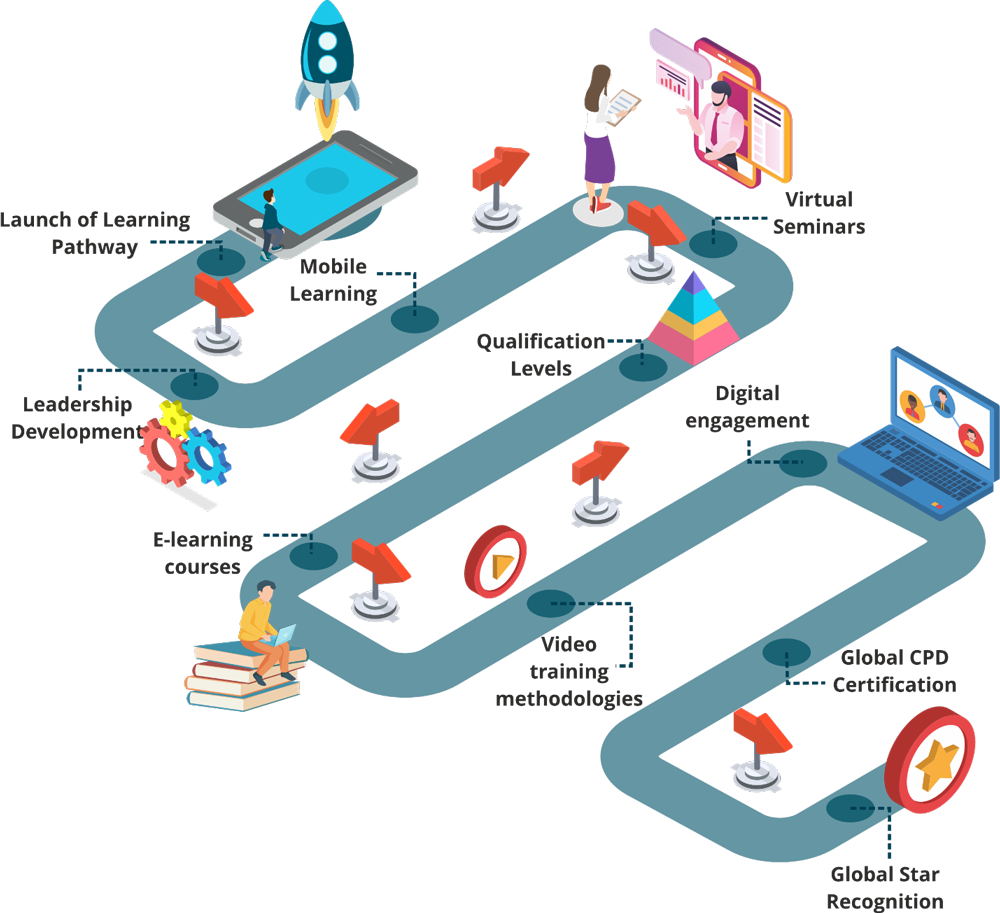

How Learning Pathways WorkThe learning pathways developed are tailor-made for executive staff, sales management and advisors. Our blended mediums of learning incorporate skills development and enhanced competence with digital engagement. Learning methodologies including mobile courses, ‘face to face’ experiential workshops and seminars, e-learning modules. All core learning has UK CPD accreditation. Click on the following link to download the Bancassurance brochure |

EXAMPLES

|

Experience our unique, globally adopted and award winning Bancassurance blended learning. Our courses enhance your customer engagement opportunities, sales skills, leadership and management competency. |

iPi Global Learning |

|

Partnerships & JVsLed Bancassurance strategic partnerships design and execution across emerging markets including Indonesia, Thailand, China, Philippines, Taiwan, China, South Africa, Kenya, Botswana, Zambia, Egypt, Pakistan, India and the UAE. |

Operational performance improvementTransformed market positioning and revenue contribution via portfolio optimisation across customer segments, product and proposition enhancement, operational processes, digital and technical transformation. |

CollaborationThe most important but often underestimated element in successful Bancassurance models is the cultural collaboration, leadership and partnership alignment of the Bank and insurance provider at all levels. This is our unique team capability demonstrated across the UK and Europe, Asia, The Middle East and Africa. |

OUR EXPERTS

iPi has brought together into one global team of industry experts who have uniquely designed, created and launched Bancassurance in many major and developing markets of the world.

This level of operational experience gives our clients confidence that their Bancassurance strategic projects are in safe and capable hands.

Rod Shay |

Ian Watts |

Our customised solutions are proven in many markets and continue to transform Bancassurance businesses.

KEY CONSULTING ProjecTS

|

AIA Asia. Hong Kong, Singapore, India, The Philippines, Indonesia and Thailand. Designed and delivered the Bancassurance Sales Executive Program and conducted trainer Assessment Centres across all Asian markets.

|

|

Designed the world's first Bancassurance Academy for Allianz in Egypt and created Asia's first Bancassurance Academy for AXA Mandiri Financial Services in Indonesia, both focusing on sales skills development and sales leadership.

|

|

Citibank Global Asia High Net Worth customer service project, in conjunction with AIA. Redesign and deliver training for HNW Relationship Management teams.

|

|

Secured JV with the world’s largest bank, ICBC China. Localised and delivered Lead Generation and Conversational Selling programs for frontline customer facing staff. Sales and revenue increased 200+% as a result.

|

|

AIA China Bancassurance transformation to profitable division.

Established specialist Bancassurance model for Citibank Saudi Arabia, SAMBA. Salaried local sales force providing long term savings and insurance related products to High Net Worth locals.

|

Simply Talk Ltd courses have been used by more than 30 Banks and Insurance organisations around the world, including AIA, Allianz, AXA, HSBC, AVIVA, and SBI Life India, Citibank

Develop the core sales and management skills of your customer facing staff, giving them the confidence to engage more closely with your key customers